Financial inclusion aims to benefit millions of the world’s poor, most of whom do not have access to formal financial services provided by banks, insurance companies or microfinance institutions.

But the widespread use of mobile phones in emerging markets has created opportunities to drive the large-scale expansion of mobile financial services, which will enable governments and private organizations to speed up financial inclusion.

What is Financial Inclusion?

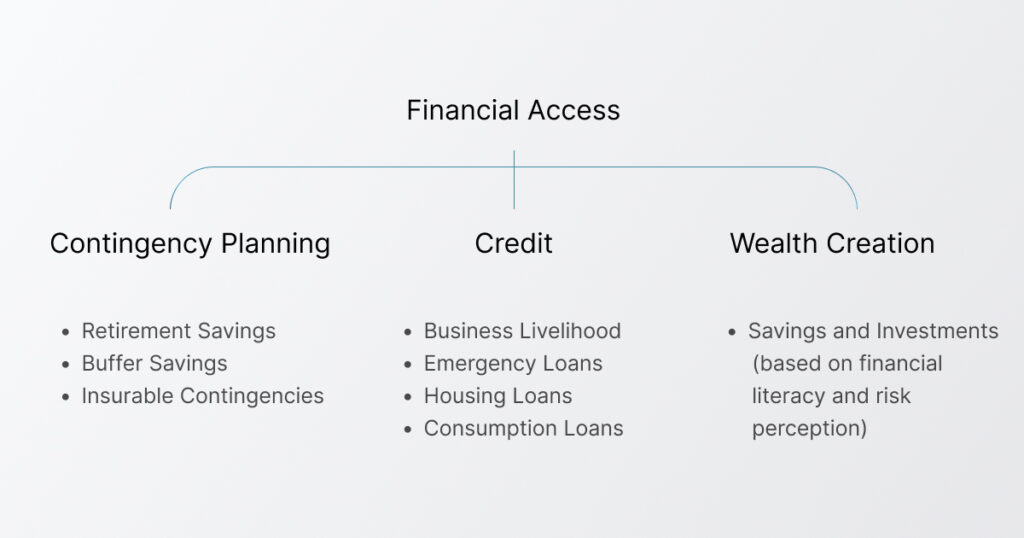

Financial inclusion aims to make financial products accessible and affordable to all individuals and businesses, regardless of their net worth and size. The goal is to deliver their needs – transactions, payments, savings, credit, and insurance – in a sustainable way.

How Financial Inclusion Works

According to worldbank.org, financial inclusion ‘facilitates day-to-day living, and helps families and businesses plan for everything from long-term goals to unexpected emergencies.’

‘As account holders, people are more likely to use other financial services, such as credit and insurance, to start and expand businesses, invest in education or health, manage risk, and weather financial shocks, which can improve the overall quality of their lives.’

Financial Inclusion Highlights

Countries that have made significant progress towards financial inclusion have:

- Policies delivered at scale, such as universal digital ID – India and Aadhaar / JDY accounts – more than 1.2 billion residents covered.

- Leveraged government payments. (For example, 35% of adults in low-income countries receiving a government payment opened their first financial account for this purpose).

- Allowed mobile financial services to thrive. (For example, in Sub-Saharan Africa, mobile money account ownership rose from 12% to 21%).

- Welcomed new business models, such as leveraging e-commerce data for financial inclusion.

- Taking a strategic approach by developing a national financial inclusion strategy (NFIS) that brings together diverse stakeholders including financial regulators, telecommunications, competition, and education ministries.

- Paying attention to consumer protection and financial capability to promote responsible, sustainable financial services.

Fintech Supporting Financial Inclusion

Numerous fintech companies also serve the cause of financial inclusion. For instance, to keep up with the demand for digital/cashless payments, mainstream banks now look to partner with agile fintech, payments, and e-commerce firms. Other fintech developments for financial access include:

- A digital loan product that unlocks credit for small businesses with no fixed collateral.

- An end-to-end healthcare marketplace that delivers micro-insurance to rural communities.

- A subscription service that helps low-income households save money by financing bulk purchases of essential goods.

- An ERP system that drives a credit scoring engine and enables partner banks to assess loan risk.

- A mobile app that enables refugees and migrant laborers to access loans, insurance, and remittances.

- Peer-to-peer (P2P) or social lending.

P2P lending has been a beneficial option for people who are not eligible for a loan from traditional banks because of their lack of credit history.

Barriers to Financial Inclusion

A significant part of the population still remains untouched due to various reasons: costs, distance, lack of trust, bureaucracy, etc.

Although public and private sectors have taken significant steps to increase financial inclusion, roughly one-third of the population, about 1.7 billion people, still remain unbanked or underbanked, according to the latest Findex Report.

From extended branches to rural unbanked areas to adjusted interest rates granted to low-income families, efforts toward achieving financial inclusion have been made over time. Recently, the proliferation of the internet and mobile phone coverage has played a major role in promoting inclusion.

The Role of Mobile Phones in Financial Inclusion

Research indicates that not only does the underbanked population want to use financial services, but that they would use mobile devices to access them.

Similar studies conducted in African countries have also found a direct relationship between financial inclusion and mobile phone penetration rate.

Using mobile phones for financial access takes place on the solid foundation of appropriate retail banking infrastructure.

This gives us the three hygiene factors of financial inclusion–proximity (retail location), trust (in banking), and affordability (low infrastructure costs).

Mobile phones have the potential to take banking transactions safely outside of bank branches and into neighborhood stores (which act as banking liaisons) or directly into the customer’s hands.

In addition, mobile-based financial inclusion also cuts across various sustainable development goals (SDG) set by the United Nations, including:

- SDG 1 (No Poverty)

- SDG 2 (Zero Hunger)

- SDG 3 (Good Health & Well-being)

- SDG 8 (Decent Work & Economic Growth)

- SDG 10 (Reduced Inequalities)

However, implementing such mobile-based banking services is challenging because it requires combining the physical assets and capabilities of mainly two domains–mobile devices and banking.

It may also require partners to provide device financing options to make mobile phones affordable. And organizations will need to work with governments to ensure regulatory needs are not prohibitive.

Leaders and organizations are working together to meet the demand for mobile-based financial access. For instance, in the Philippines, payment provider company G-Cash has over 60 million users, and Kenya’s m-Pesa has more than 30 million registered users.

And M-Kesho in Kenya is developing financial offerings that provide savings, credit, and insurance over mobile phones.

On the other side of financial inclusion, software technology companies are working to enable people from low- and middle-income with internet-enabled handsets.

For example, NuovoPay’s partners and SaaS providers, Angaza and PaygOps provide device financing options to millions of people at the bottom of the pyramid at affordable rates.

The partnership ensures that people obtain mobile phones easily and the providers–telecom carriers, OEMs, or banks–protect their financial investment.

This arrangement speeds up the distribution of mobile phones to a largely low-income population with no borrowing history or credit score.

Mobile phones for sending and receiving money are important to provide access to financial offerings to the unbanked population.

Read more: A Quintessential Guide To Device Financing

Wrapping Up

Financial inclusion is a major step towards inclusive growth. And mobile phones are a low-cost and practical approach to helping the underserved population be a part of the financial ecosystem. Underprivileged customers get to interact with banks and achieve financial security and growth, which wouldn’t have been possible without the use of mobile phones.

References: